-

How does the budget affect my business?

How do the budget and the Employment Rights Bill impact my business? The budget, together with the recent announcements regarding the Employment Rights Bill are causing significant concern for employers in small businesses. Over the past few years, the cost of doing business generally has been increasing due to Covid, Brexit, the War in Ukraine…

-

What’s The Deal With Pay Reviews?

Between COVID and Brexit, there’s been a lot of uncertainty around pay reviews this year. Many employers just don’t feel safe putting up salaries at the moment, but some are looking to see whether they can at least give a cost of living increase as we ride out the storm. The Office for National Statistics…

-

What do they really want?

I had a conversation with a client this week about the struggles they are having to improve performance. They are a recruitment agency, so like other recruitment agencies and estate agents who we look after, the staff are set targets and are paid on their performance. However, from our conversation, it appears that the incentive…

-

What is flexible working?

The term ‘flexible working’ means lots of different things depending on who you are speaking to. To some it is the ability to work part-time, to others the ability to work from home and to others the ability to work shifts or on a zero hours basis. The right to request flexible working has been…

-

Pay Increases All Round?

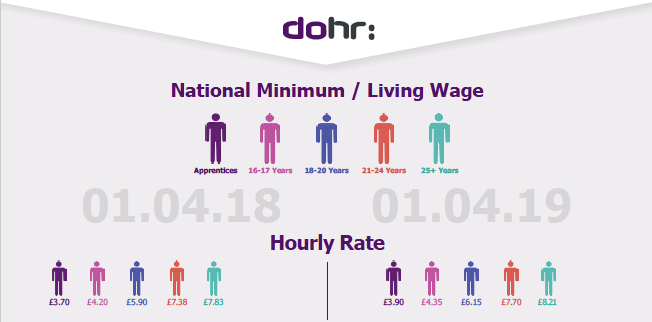

The National Minimum Wage, known as the National Living Wage for over 25s, is probably one of the most significant changes in Employment Law of the past few decades. For many it was a huge step forward for workers’ rights in the UK and one of the main achievements of Blair’s government. It has not…

-

Snow Days

How to manage staff when the English weather turns is always a topic for discussion among employers. In this video (one from our #AskDOHR series) we give employers different elements which they need to consider when making decisions about their business and whether or not to pay staff who fail to come to work…

-

Is it a Duck?

The Employment Tribunal has ruled that two drivers are infact ‘workers’ under the definition in the Employment Rights Act 1996 and therefore are afforded protections not available to genuine freelancers. This case will be appealed by Uber, they can’t afford not to because of the implications for their global business model. Uber have also looked…

-

The Employment Legislation Outlook

Below is a summary of planned employment legislation changes. There are a couple of things to note: There was no statutory increase in rates in April of this year, except for Redundancy which increased by £4 per week There may be an alignment of the National Minimum Wage Increases and the National Living Wage increases…

-

David Cameron and the 19.1% hot potato

It just seems like it’s one HR hot potato after another right now! On Tuesday, David Cameron announced plans to bring forward a rule that will mean that companies with more than 250 staff will have to disclose the pay gap between their male and female employees. As things currently stand, for full and part-time…

-

Do I have to pay staff if they don’t come to work due to the snow?

On days like today, when the snow is falling steadily and settling rapidly, we are often asked about withholding pay for absent staff. Our first response is always “What does your contract say”? As a general rule, if staff are absent from work and it is not for pre arranged holiday, then as an employer,…